For entrepreneurs, startups, and investors, one of the first and most crucial questions is: How big is the opportunity? The answer lies in understanding the Total Addressable Market (TAM). At its core, TAM defines the overall revenue potential available if a product or service were to achieve 100% market share within its target industry. In simpler terms, it represents the universe of opportunity for any business. Whether you’re preparing to start a new business, or developing a detailed business plan, knowing the size of your TAM provides clarity and direction. It not only guides strategic planning but also plays a decisive role in convincing investors, shaping product roadmaps, and identifying long-term growth potential. Without an accurate grasp of the total addressable market, companies risk overestimating or underestimating their potential, which can lead to poor decision-making and wasted resources. By combining structured market research with proven calculation methods, this article explores everything you need to know about TAM—its definition, formula, real-world examples, pitfalls, and how it differs from SAM and SOM—while providing practical tools and insights to apply it effectively.

What is Total Addressable Market (TAM)?

Total Addressable Market (TAM) is the maximum market demand for a product or service, assuming no competition and 100% adoption. It measures the total revenue opportunity available within a specific market. For example, if a company develops a ride-hailing app, its TAM might be the entire global transportation services industry.

It’s important to distinguish TAM from two related concepts:

- Serviceable Available Market (SAM): The segment of the TAM targeted by a company’s products or services that is realistically reachable.

- Serviceable Obtainable Market (SOM): The portion of the SAM that the business can reasonably capture, given competition, budget, and operational capacity.

Think of TAM as the widest circle in a funnel, representing the entire opportunity. SAM narrows it down to what you can target, and SOM pinpoints what you can realistically achieve.

Why is TAM Important?

Understanding TAM is vital for several reasons:

- Business Planning: Startups use TAM to validate whether the opportunity is big enough to justify launching or scaling. A product may be innovative, but if the TAM is too small, profitability will be limited.

- Investor Decision-Making: Venture capitalists and angel investors often evaluate TAM before funding. A large TAM signals scalability and long-term growth potential.

- Product Development: Knowing TAM helps businesses identify market gaps, prioritize features, and decide where to innovate.

- Market Entry Strategy: TAM insights reveal whether to enter new regions, expand into adjacent markets, or diversify product lines.

In short, TAM isn’t just a number—it’s a strategic lens that shapes vision and execution.

Methods to Calculate Total Addressable Market (TAM)

There are three main approaches to estimating TAM. Each method offers unique strengths and limitations, and businesses often combine them for accuracy.

1. Top-Down Approach

This method uses industry research reports, analyst data (from sources like Gartner or Statista), and government databases to estimate market size.

- Pros: Quick and accessible, especially for startups with limited data.

- Cons: Often too broad, failing to account for competition, customer behavior, or niche segments.

Example: A SaaS company might find a Gartner report showing the global enterprise software market is worth $600 billion. This figure gives a ballpark TAM but doesn’t reflect the company’s exact target market.

2. Bottom-Up Approach

This method builds TAM from internal data such as pricing and customer acquisition.

- Formula: Average Revenue per User (ARPU) × Number of Potential Customers.

- Pros: More accurate, grounded in actual data.

- Cons: Requires reliable pricing models and customer insights.

Example: If a SaaS company charges $100 per month and estimates 1 million potential customers, TAM = $100 × 12 × 1,000,000 = $1.2 billion annually.

3. Value-Theory Approach

This method estimates TAM by evaluating customer willingness to pay for the value a product provides. It’s especially useful for innovative products.

- Pros: Ideal for disruptive solutions with no existing benchmarks.

- Cons: Difficult to measure accurately.

Example: When Apple launched the first iPhone, the TAM wasn’t just the phone industry—it expanded into digital entertainment, apps, and internet services, creating a much larger market.

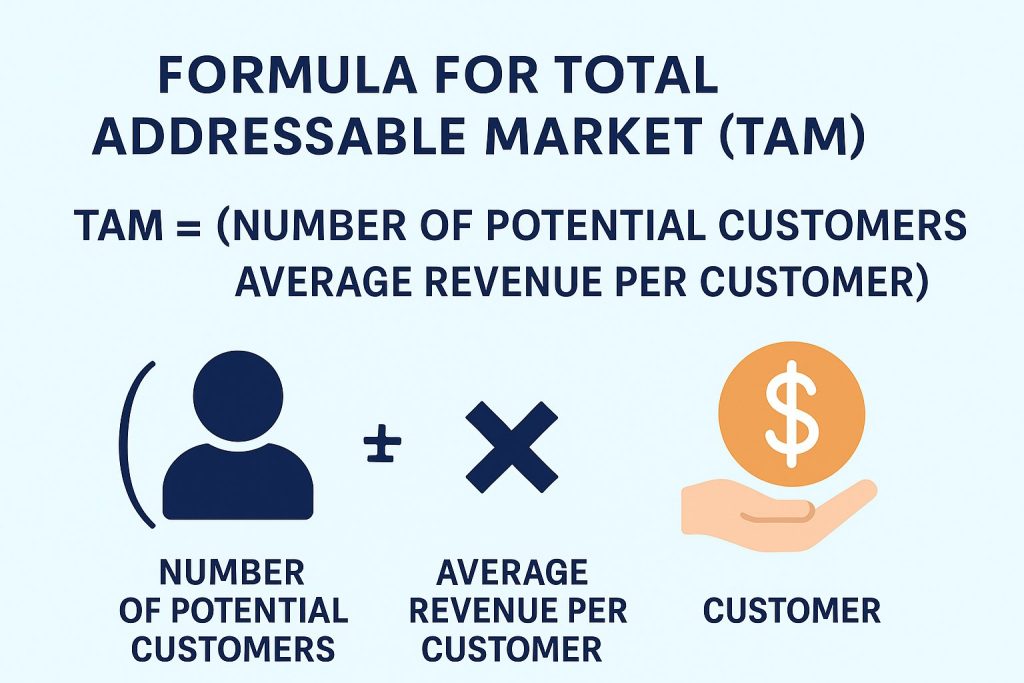

Formula for Total Addressable Market (TAM)

The most commonly used formula is:

TAM = (Number of Potential Customers × Average Revenue per Customer)

Example Calculation

Suppose a company sells a subscription-based productivity app for $120 per year. If there are 5 million professionals in the target region:

TAM = 5,000,000 × $120 = $600,000,000

This means the maximum revenue opportunity in that market is $600 million annually. The calculation can be adapted for SaaS (ARPU-based), manufacturing (units × price), or eCommerce (customer segments × purchase frequency × average spend).

Real-World Examples of TAM

- Uber: Its TAM is based on the global transportation services market, valued at trillions of dollars. Uber’s pitch to investors highlighted the vast scale of its potential.

- Airbnb: Initially targeting the hospitality sector, Airbnb expanded its TAM by positioning itself as part of the $1 trillion global travel and accommodation market.

- Spotify: Spotify’s TAM is the global digital music streaming market, worth billions. By showcasing this figure, Spotify secured investments and established itself as a market leader.

These examples demonstrate how TAM plays a crucial role in scaling and valuation.

Common Mistakes in TAM Estimation

- Inflated Projections: Using overly optimistic numbers from generic reports without narrowing to the target audience.

- Confusing TAM with SAM or SOM: Entrepreneurs often present TAM as achievable revenue, which misleads investors.

- Ignoring Niche Segmentation: Overlooking regional, demographic, or behavioral differences can skew calculations.

- Overestimating Growth Potential: Assuming 100% adoption is unrealistic.

Avoiding these mistakes requires combining data-driven insights with realistic assumptions.

TAM vs SAM vs SOM: A Funnel Analogy

To better understand, imagine a funnel:

- TAM (Top of the Funnel): The entire potential market.

- SAM (Middle of the Funnel): The segment your products or services can serve.

- SOM (Bottom of the Funnel): The actual share you can realistically capture.

Example: A SaaS company targeting small businesses:

- TAM = $50 billion (all businesses globally).

- SAM = $5 billion (businesses in North America).

- SOM = $500 million (share it can realistically win in the next five years).

This layered approach adds credibility to financial projections.

Tools and Resources for TAM Calculation

Several tools and data sources can help refine TAM estimates:

- Market Research Firms: Gartner, IDC, IBISWorld, McKinsey.

- Databases: Statista, Crunchbase, CB Insights.

- Digital Tools: Google Trends, SEMrush, Ahrefs for keyword-based market estimation.

- Investor Platforms: PitchBook for startup and industry benchmarks.

By combining these resources with internal data, entrepreneurs can create accurate and defensible TAM estimates.

Why TAM Is Not Everything

While TAM is essential, it doesn’t guarantee success. A large TAM means little without execution. Investors also look at:

- Product-market fit.

- Customer acquisition strategies.

- Team expertise and operational efficiency.

- Competitive advantage.

In fact, some of the most successful startups began with small TAMs but grew by innovating and creating new markets.

Key Takeaways

The Total Addressable Market (TAM) is more than a number—it’s the foundation for business planning, fundraising, and strategic growth. By accurately defining TAM, entrepreneurs gain clarity about opportunities, investors gauge scalability, and businesses align their products with market needs. However, TAM must be complemented by strong execution, realistic assumptions, and a clear path to customer acquisition. Startups should calculate TAM using a mix of top-down, bottom-up, and value-theory approaches while learning from real-world examples like Uber, Airbnb, and Spotify. Ultimately, understanding TAM gives businesses a competitive edge, ensures credibility with investors, and provides a roadmap for scaling. Before you pitch your next big idea or enter a new market, make sure your TAM is not just calculated—but well-understood.